In-Depth INFINOX Broker Evaluation 2025: Trustworthiness & Trading Conditions

In-Depth INFINOX Broker Evaluation 2025: Trustworthiness & Trading Conditions Examined

Since launching operations in 2009, INFINOX has evolved into a distinguished multi-regulated brokerage firm providing access to global financial markets. Operating across more than 15 countries, the platform facilitates trading in currency pairs, raw materials, stock indices, corporate shares, and derivative contracts. INFINOX distinguishes itself through transparent pricing models, client-centric operations, and adherence to stringent financial regulations, establishing credibility among retail participants and institutional investors seeking dependable market connectivity.

Quick Reference Guide: Essential INFINOX Data Points

|

Evaluation Criteria |

INFINOX Features |

Typical Broker Standards |

|

Operating Since |

2009 (16 years) |

Varies |

|

Starting Capital |

0.01 lot minimum |

$100-250 typical |

|

Available Markets |

900 financial products |

200-500 average |

|

Software Solutions |

MT4, MT5, IX Social, IX SYNC |

Usually MT4/MT5 only |

|

Transaction Expenses |

Industry-competitive |

Highly variable |

|

Margin Requirements |

Maximum 1:1000 ratio |

Maximum 1:500 typical |

|

User Ratings |

4.7/5 Excellent |

3.5-4.0/5 standard |

|

Operational Footprint |

15 territories |

Regional focus |

|

Licensing Status |

Multiple authorities |

Often single regulator |

This reference framework illustrates INFINOX's position as a provider of comprehensive trading infrastructure with global operational capabilities.

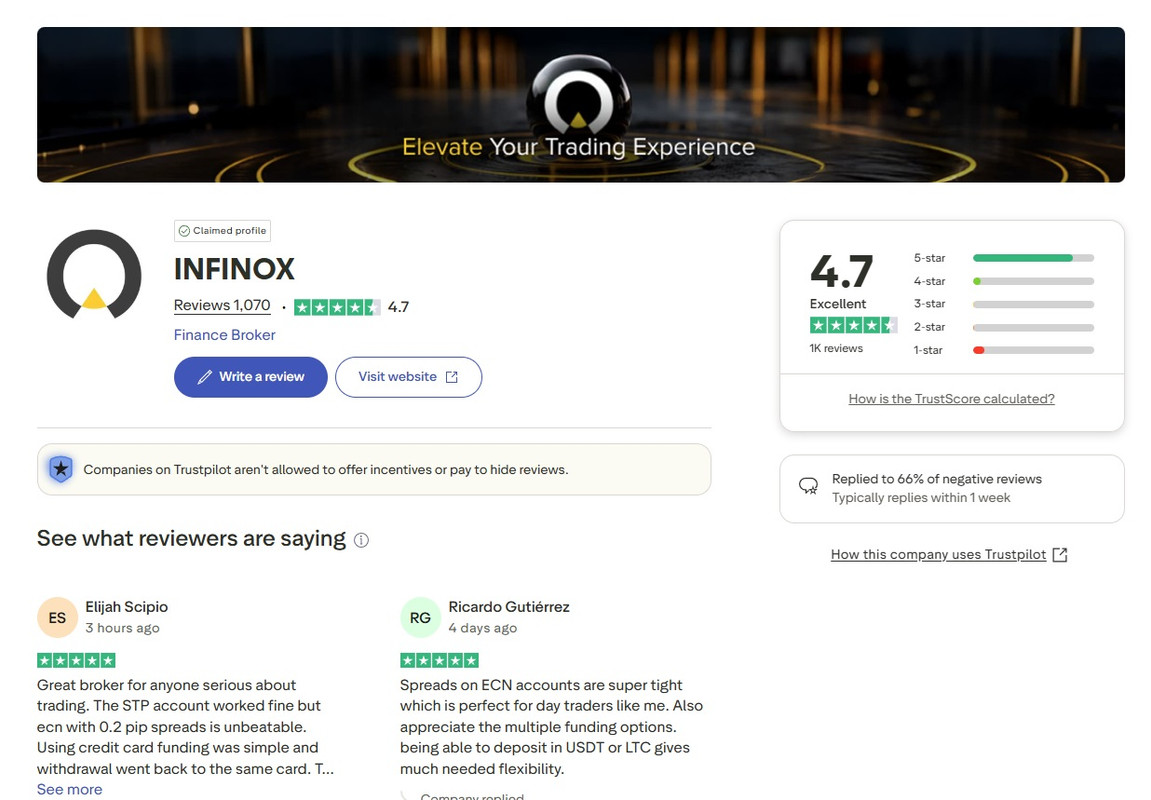

User Feedback Analysis: Examining Trustpilot Ratings

INFINOX achieves remarkable client approval with a 4.7 out of 5 star "Excellent" designation on Trustpilot, accumulated from over 1,069 authenticated user experiences. This rating considerably surpasses conventional forex brokerage performance metrics, which typically fall within 3.5-4.0 star ranges.

Caption: INFINOX Trustpilot reviews with a 4.7 Excellent rating based on over 1,000 client experiences.

The breakdown of customer assessments demonstrates strong positive trends:

- Exceptional (5-star): Predominant feedback category

- Positive (4-star): Substantial secondary grouping

- Neutral (3-star): Minimal representation

- Negative (2-star): Rare occurrences

- Critical (1-star): Infrequent submissions

Positive Client Testimonials: Service Highlights

Verified user submissions frequently emphasize these elements:

- Technology Reliability: "The MT5 platform runs super smooth and spreads are tight on my ECN account"

- Order Processing: "I trade both FX majors and some US stocks on MT4 and haven't experienced any lag"

- Service Responsiveness: "The assistance is amazing, very fast and very friendly"

- Training Materials: "Honestly impressed with their IX Education Hub. As a beginner I learned the basics of forex, indices, and commodities"

- Payment Processing: "Fast funding with BTC and quick withdrawals to Sticpay"

Constructive Feedback: Client Suggestions

Certain reviewers propose refinements including:

- Broader selection of uncommon currency combinations

- Improved transparency in complex account situations

- Extended digital currency instrument availability

The brokerage actively engages with customer concerns, addressing 66% of unfavorable reviews within seven days, illustrating dedication to service quality and problem resolution.

Business History & Licensing Framework

INFINOX maintains operational centers throughout Latin American nations, Middle Eastern and North African territories, European markets, and Asian regions. From its 2009 establishment, the organization has secured strategic relationships with distinguished entities including the BWT Alpine F1® Team, reflecting alignment with excellence standards and performance optimization principles.

The company's compliance structure provides multilayered client safeguards through authorization from multiple respected financial authorities. Research evidence suggests that brokers maintaining licenses across several jurisdictions typically offer enhanced consumer protections and operational transparency compared to single-authority entities.

Licensing Authority Breakdown

|

Geographic Region |

Supervising Entity |

Permit Classification |

Investor Safeguards |

|

Caribbean Territory |

Securities Commission of the Bahamas (SCB) |

Unrestricted Operations License |

Client fund separation |

|

African Region |

Financial Services Commission Mauritius (FSC) |

Investment Dealer Authorization |

Continuous oversight |

|

European Market |

Financial Conduct Authority UK (FCA) |

Complete Authorization |

Compensation scheme access |

Beyond regulatory compliance, INFINOX implements supplementary financial protection reaching USD 1,000,000 per qualifying individual through specialized insurance arrangements valid until May 2026. This coverage substantially exceeds typical brokerage protection standards and reinforces the firm's emphasis on capital security.

Available Account Configurations & Trading Solutions

INFINOX presents multiple account frameworks addressing requirements across beginner, intermediate, and professional trading populations. The infrastructure incorporates Electronic Communication Network (ECN) connectivity and Straight Through Processing (STP) routing, both providing substantial market depth, sophisticated order execution, and complete analytical tool access.

Comparative Account Analysis: STP vs ECN Models

|

Account Parameter |

STP Framework |

ECN Framework |

|

Bid-Ask Differential |

Beginning at 0.9 pips |

Beginning at 0.2 pips |

|

Borrowing Power |

Maximum 1:1000 ratio |

Maximum 1:1000 ratio |

|

Per-Trade Charges |

Zero fees |

Starting at 7 GBP/EUR/USD/AUD |

|

Minimum Contract |

0.01 lot threshold |

0.01 lot threshold |

|

Account Category |

Primary designation |

Alternative option |

|

Multi-Account Access |

Supported |

Supported |

STP Framework Benefits: Zero-commission environment combined with reasonable spread costs makes this configuration optimal for traders holding positions over extended periods and those preferring straightforward expense calculations.

ECN Framework Benefits: Direct market access with spreads commencing at 0.2 pips, balanced against per-lot commissions beginning at 7 currency units. This structure typically advantages scalping methodologies and rapid-execution trading approaches where minimal spreads take priority.

Account Holder Categories Available

|

Ownership Type |

Intended Users |

Key Characteristics |

|

Single Owner |

Individual traders |

Complete control, personal responsibility |

|

Multiple Owners |

Partnerships, families |

Shared access, joint decision authority |

|

Business Entity |

Corporations, funds |

Institutional framework, compliance infrastructure |

INFINOX accommodates various organizational structures ensuring appropriate solutions for independent traders, collaborative partnerships, and corporate trading operations.

Client Registration Procedure & Requirements

INFINOX employs a condensed three-stage registration system facilitating rapid account establishment while maintaining regulatory compliance obligations. The preliminary application form requires basic information and typically completes within minutes.

Stage One - Profile Creation: Submit essential information through the digital application portal and complete identity verification procedures

Stage Two - Capital Deposit: Transfer initial funds to the designated trading account enabling immediate market participation

Stage Three - Trading Activation: Access the complete instrument catalog featuring 900 tradable assets across global markets

Authentication protocols align with international Know Your Customer (KYC) requirements established by financial regulatory bodies. Standard verification processing completes within 24-48 business hours, positioning traders to capitalize on emerging market conditions. Risk-free demonstration accounts permit strategy testing and platform familiarization before committing real capital.

Trading Software & Technological Infrastructure

INFINOX provides access to industry-standard and proprietary trading technologies suitable for novice participants through institutional-level operations. Each software solution delivers specialized functionality tailored to particular trading preferences and operational requirements.

MetaTrader 4 Platform Capabilities

MT4 functions as the established foundation for currency trading globally, incorporating sophisticated visualization tools alongside 30 integrated technical calculation modules. The software accommodates algorithmic strategy implementation through Expert Advisor (EA) programming, enabling systematic analysis and automated position management.

Primary Features:

- Visual Analytics: Comprehensive charting infrastructure supporting intricate technical analysis methodologies across multiple timeframe selections

- Indicator Library: 30 pre-installed calculation tools, customizable analytical objects, 4 pending order categories, 9 distinct timeframe options

- Rapid Execution: Single-action trade placement eliminating confirmation requirements, maximizing order processing velocity

- Automated Systems: EA compatibility facilitating algorithmic analysis and mechanical trading system deployment

MetaTrader 5 Advanced Features

MT5 represents the next-generation platform evolution, expanding beyond forex specialization into comprehensive multi-asset trading environments. The software incorporates 38 built-in technical indicators alongside enhanced analytical capabilities unavailable in predecessor versions.

Enhanced Functionality:

- Execution Versatility: Multiple position accounting methods (netting/hedging) with various execution protocols including instant, request, market, and exchange routing

- Expanded Analytics: 38 integrated calculation modules, order book visualization, dual accounting systems, 6 pending order types, 21 timeframe selections

- Economic Integration: Built-in economic calendar providing real-time macroeconomic releases and market-moving announcements

- Cloud Infrastructure: Virtual server integration ensuring continuous algorithmic operation and minimized latency through distributed computing architecture

Proprietary Platform Innovation: IX Social & IX SYNC

These exclusive technologies demonstrate INFINOX's commitment to platform advancement, incorporating community-driven trading features and cross-device synchronization capabilities unavailable through standard MetaTrader installations.

Platform Feature Comparison Matrix

|

Capability |

MT4 |

MT5 |

IX Social |

IX SYNC |

|

Technical Indicators |

30 |

38 |

Custom |

Integrated |

|

Algorithmic Trading |

Yes |

Yes |

Limited |

Yes |

|

Economic Calendar |

No |

Yes |

Yes |

Yes |

|

Social Features |

No |

No |

Yes |

Partial |

|

Mobile Optimization |

Yes |

Yes |

Yes |

Yes |

|

Multi-Asset Support |

Limited |

Full |

Full |

Full |

Tradable Instruments & Market Access

INFINOX facilitates exposure to 900 financial instruments distributed across major asset classifications, providing diversification opportunities and strategic positioning capabilities across global markets.

Currency Pair Trading Opportunities

The foreign exchange catalog encompasses major pairs (EUR/USD, GBP/USD, USD/JPY), minor combinations (EUR/GBP, AUD/NZD, CAD/CHF), and exotic pairings (USD/TRY, EUR/ZAR, USD/MXN) featuring competitive pricing structures. Non-European Economic Area clients access maximum 1:1000 leverage ratios, while EU-based accounts operate under ESMA-mandated restrictions ensuring responsible margin utilization.

Commodity & Energy Derivatives

Precious Metals Selection:

- Gold (XAU/USD) - Safe-haven asset and inflation hedge

- Silver (XAG/USD) - Industrial and investment demand driver

- Platinum (XPT/USD) - Automotive catalyst material

- Palladium (XPD/USD) - Technology sector applications

Energy Products Available:

- Crude Oil (Brent & WTI) - Global energy benchmark

- Natural Gas - Heating and electricity generation commodity

Agricultural Commodities:

- Soft commodities including wheat, corn, coffee, and sugar providing portfolio diversification

Index & Equity CFD Products

|

Asset Category |

Examples |

Leverage Range |

Primary Use |

|

Major Indices |

S&P 500, NASDAQ, DAX 40 |

Up to 1:500 |

Market exposure |

|

Regional Indices |

FTSE 100, CAC 40, Nikkei 225 |

Up to 1:200 |

Geographic focus |

|

Stock CFDs |

Apple, Tesla, Microsoft |

Up to 1:20 |

Individual equity |

|

Sector Exposure |

Technology, Healthcare, Energy |

Varies |

Thematic investing |

Futures Contract Availability

Selected futures instruments across commodity, index, and currency categories provide professional traders with standardized contract specifications, transparent pricing mechanisms, and comprehensive risk management capabilities through established exchange infrastructure.

Instrument Accessibility Summary

|

Asset Class |

Number Available |

Typical Spread |

Trading Hours |

|

Forex Pairs |

60 |

From 0.2 pips |

24/5 continuous |

|

Commodities |

20 |

Variable |

Varies by asset |

|

Stock Indices |

15 |

From 0.5 points |

Market hours |

|

Individual Stocks |

800 |

From 0.1% |

Exchange hours |

|

Futures |

Select markets |

Competitive |

Exchange specific |

Pricing Structure & Cost Components

INFINOX implements transparent fee schedules across account categories, operating dual pricing methodologies enabling traders to select expense frameworks matching their operational frequency and strategic requirements.

Detailed Cost Breakdown

|

Fee Category |

STP Account |

ECN Account |

Industry Benchmark |

|

EUR/USD Spread |

From 0.9 pips |

From 0.2 pips |

0.5-1.5 pips |

|

GBP/USD Spread |

From 1.2 pips |

From 0.4 pips |

0.8-2.0 pips |

|

Gold Spread |

From 0.3 pips |

From 0.15 pips |

0.2-0.5 pips |

|

Commission Rate |

None |

7 currency units/lot |

Varies widely |

|

Deposit Fees |

Zero |

Zero |

Often 0-2% |

|

Withdrawal Fees |

Zero |

Zero |

Often $10-50 |

|

Inactivity Charges |

Not disclosed |

Not disclosed |

$10-15/month typical |

Spread-Based Accounts: Simplified pricing without per-transaction charges, appealing to position traders and those maintaining holdings across extended timeframes.

Commission-Based Accounts: Reduced spreads offset by standardized per-lot fees, generally advantageous for high-frequency operations where accumulated spread costs would exceed commission expenses.

Overnight Financing: Interest rate differentials apply to positions held beyond daily settlement, calculated based on interbank rates plus broker markup. Specific rates fluctuate according to instrument characteristics and prevailing market conditions.

Trading Cost Example Scenarios

|

Scenario |

Account Type |

Position Size |

Entry Cost |

Total Round-Trip |

|

EUR/USD Day Trade |

STP |

1.0 lot |

$9 spread |

$18 |

|

EUR/USD Day Trade |

ECN |

1.0 lot |

$2 spread $7 commission |

$18 |

|

Gold Swing Trade |

STP |

0.5 lot |

$15 spread |

$30 |

|

GBP/USD Scalp |

ECN |

0.1 lot |

$0.40 spread $0.70 commission |

$2.20 |

Customer Assistance & Support Services

INFINOX operates comprehensive client support infrastructure functioning continuously throughout the trading week. Multilingual support teams spanning 15 languages ensure traders receive assistance in their native language regardless of geographical location.

Support Channel Comparison

|

Contact Method |

Availability |

Response Time |

Best For |

|

Live Chat |

24/7 |

Immediate |

Urgent queries |

|

Email Support |

24/7 |

2-24 hours |

Detailed issues |

|

Phone Lines |

Regional hours |

Immediate |

Complex problems |

|

Messaging Apps |

24/7 |

Under 1 hour |

Convenient access |

|

Support Tickets |

24/7 |

24-48 hours |

Documentation needs |

Response efficiency maintains consistently high standards, with live chat connecting users to knowledgeable representatives within seconds during peak hours. Support personnel demonstrate expertise extending beyond basic technical assistance, providing trading guidance and market context when appropriate.

Learning Resources & Market Research

INFINOX allocates substantial resources toward trader education through comprehensive learning materials accessible to all account holders. The educational infrastructure supports skill development from fundamental concepts through advanced trading methodologies.

Caption: INFINOX Education Hub offering free video courses, eBooks, and daily market insights.

Educational Component Overview:

- Multimedia Instruction: Professional video series covering technical analysis, fundamental analysis, risk management, and platform operation across multiple languages

- Market Commentary: Daily analytical reports identifying potential trading opportunities with expert commentary on market conditions

- Interactive Sessions: Real-time market analysis through live streaming format with professional trader participation

- Written Guides: Extensive documentation covering trading concepts, strategies, and market analysis techniques

- Community Engagement: Dedicated communication channels facilitating trader networking, strategy discussion, and market insight sharing

Education Resource Accessibility Matrix

|

Resource Type |

Beginner Friendly |

Cost |

Update Frequency |

Languages |

|

Video Courses |

Yes |

Free |

Quarterly |

15 |

|

Daily Analysis |

Moderate |

Free |

Daily |

Multiple |

|

Live Sessions |

Moderate |

Free |

Daily |

English primary |

|

eBooks |

Yes |

Free |

Annual |

10 |

|

Community |

Yes |

Free |

Continuous |

Various |

These offerings accommodate traders across proficiency spectrums, from beginners establishing foundational knowledge through experienced practitioners seeking sophisticated analytical perspectives.

Asset Protection & Security Protocols

Client capital security constitutes a foundational element of INFINOX's operational philosophy. Segregated account structures ensure trading funds remain isolated from corporate operational capital, providing statutory protection aligned with regulatory mandates across operating jurisdictions.

Client Protection Measures

|

Protection Type |

Coverage Details |

Eligibility |

Activation Trigger |

|

Segregated Funds |

Complete separation |

All clients |

Standard practice |

|

Insurance Policy |

Up to $1M per client |

Eligible claimants |

Insolvency event |

|

Negative Balance |

Cannot lose beyond deposit |

Retail clients |

Market volatility |

|

Regulatory Compensation |

Varies by jurisdiction |

Licensed territory clients |

Broker failure |

The enhanced insurance arrangement providing USD 1,000,000 coverage per qualifying individual (effective June 2024 through May 2026) substantially exceeds standard brokerage protection thresholds. This supplementary safeguard demonstrates organizational commitment to capital preservation beyond minimum regulatory requirements.

Negative Balance Protection: Retail participants cannot incur losses exceeding account balance even during extreme market dislocations, aligning with contemporary regulatory expectations and responsible brokerage practices.

Professional Recognition & Industry Awards

INFINOX has accumulated numerous accolades throughout 2025, validating service quality and operational excellence across multiple performance dimensions:

2025 Award Summary

|

Award Title |

Awarding Organization |

Category |

Significance |

|

Best IB/Affiliate Programme |

Money Expo Mexico |

Partnership |

Partner relations |

|

Best Global Broker |

Money Expo Colombia |

Overall Excellence |

Comprehensive service |

|

Most Trusted Multi-Asset Platform |

World Business Outlook |

Trust |

Client confidence |

|

Most Innovative Trading Platform |

Global Brand Frontier Awards |

Technology |

Platform advancement |

|

Best Forex Broker Globe |

Brand Review Magazine |

Forex Specialization |

Currency trading |

|

Leading CFD Broker LATAM |

Brand Review Magazine |

Regional Excellence |

Latin American leadership |

These distinctions reflect consistent performance across innovation, trustworthiness, and service delivery dimensions, validated through independent industry evaluation processes.

Corporate Partnerships & Sponsorships

INFINOX maintains a strategic alliance with the BWT Alpine F1® Team, extending beyond conventional sponsorship arrangements. This collaboration embodies mutual values including precision execution, performance optimization, and continuous boundary expansion.

Both organizations operate within intensely competitive environments demanding meticulous preparation, adaptive strategic frameworks, and unwavering commitment to excellence. The partnership symbolizes INFINOX's association with elite-level organizations sharing comparable operational philosophies and performance standards.

Strengths & Weaknesses: Balanced Assessment

Notable Advantages

- Multi-jurisdictional regulatory authorizations providing comprehensive legal protections

- Exceptional instrument variety featuring 900 tradable assets across asset classes

- Multiple platform options incorporating industry-standard and proprietary technologies

- Competitive margin ratios reaching 1:1000 for qualified accounts

- Continuous multilingual support coverage throughout trading week

- Extensive educational content and ongoing market research

- Supplementary insurance coverage reaching USD 1,000,000 per claimant

- Established global presence with regional support infrastructure

- Multiple independent awards recognizing service excellence

- Diverse account structures accommodating various trading methodologies

- Zero-commission options and institutional-grade ECN connectivity

Identified Limitations

- European Union leverage restrictions mandated by ESMA regulations

- Limited cryptocurrency selection relative to specialized digital asset platforms

- Platform sophistication may present initial learning curve for inexperienced traders

- Insurance policy temporary (expires May 2026, renewal status uncertain)

Competitive Positioning Analysis

|

Comparison Factor |

INFINOX |

Typical Competitor |

INFINOX Advantage |

|

Regulatory Status |

Multi-tier |

Single authority |

Enhanced protection |

|

Instrument Count |

900 |

200-500 |

Superior variety |

|

Platform Options |

4 distinct |

1-2 standard |

Greater flexibility |

|

Client Satisfaction |

4.7/5 stars |

3.5-4.0/5 |

Higher approval |

|

Support Coverage |

24/7 multilingual |

Limited hours |

Better accessibility |

|

Insurance Coverage |

$1M per client |

Standard minimums |

Exceptional security |

Concluding Analysis: INFINOX Suitability Assessment

INFINOX demonstrates substantial commitment to comprehensive trading solutions supported by rigorous regulatory compliance and client-focused service delivery. The broker's extensive instrument catalog, competitive operational conditions, and recognized platform technology position it favorably for traders across experience categories.

Caption: INFINOX company overview highlighting mission, global presence, and trading platforms.

The integration of diversified regulatory oversight, innovative technological infrastructure, and thorough educational resources establishes a trading environment prioritizing participant success. Performance metrics and independent industry recognition validate INFINOX's standing as a premier global brokerage provider.

For market participants seeking dependable, comprehensively regulated market access with extensive instrument availability and professional-grade analytical tools, INFINOX presents a compelling option. The organization's transparent fee disclosure, robust client protection frameworks, and ongoing innovation focus make it particularly appropriate for active traders and strategic long-term investors.

INFINOX is a regulated broker that emphasizes client success through technological innovation, operational transparency, and industry-leading service standards across all market conditions.

Ideal Client Profiles:

- Active forex traders requiring tight spreads and rapid execution

- Portfolio diversification seekers needing multi-asset access

- Algorithm traders utilizing EA strategies on MT4/MT5

- Beginning traders valuing educational resources and demo accounts

- International traders requiring multilingual support

Common Questions: INFINOX Information

What regulatory authorities oversee INFINOX operations?

INFINOX maintains authorizations from the Financial Services Commission (Mauritius), Securities Commission of the Bahamas, and Financial Conduct Authority (United Kingdom), establishing comprehensive regulatory oversight across multiple respected jurisdictions.

What minimum capital is required to begin trading?

INFINOX accommodates various capital levels with positions available from 0.01 lot minimums, creating accessibility across different investment budgets without imposing arbitrary minimum deposit thresholds.

Can United States residents open INFINOX accounts?

Regulatory limitations typically prevent US resident participation. Prospective American clients should verify current eligibility status during the registration process or through direct customer service inquiry.

What is the standard withdrawal processing timeframe?

Withdrawal requests process through identical payment channels used for deposits. Processing durations vary by selected payment method, with electronic wallets typically completing fastest (hours to 1 day) and bank transfers requiring 2-5 business days.

Does INFINOX suit traders without previous experience?

Affirmative, INFINOX provides comprehensive educational materials, risk-free demonstration accounts, and intuitive platform interfaces appropriate for traders developing foundational skills while offering sufficient sophistication for experienced market participants.

Are there account maintenance or inactivity fees? Specific inactivity fee policies should be confirmed through account documentation or customer service inquiry, as policies may vary by account type and regulatory jurisdiction.